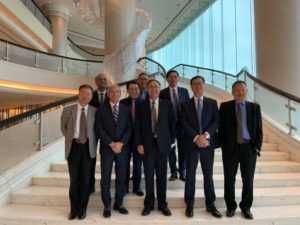

Frontage Holdings Corporation Celebrates a Successful Initial Public Offering on the HKEx

(June 3, 2019 – Exton, PA) Frontage Holdings Corporation, the parent company of Frontage Laboratories, Inc., a fast-growing contract research organization, specializing in R&D product development services, with operations in both the United States and China, announced on May 30th that the Company’s Shares have initiated trading on the Main Board of The Stock Exchange of Hong Kong.

Dr Song Li, Founder, Honorary Chairman of Frontage said, “We are recognized as a leader among CRO companies in the United States, in terms of quality, reliability, affordability, productivity, technology and regulatory compliance. Our successful listing today marks another important milestone in our development history.”

Looking forward, Frontage will leverage the net proceeds to further expand the Company’s product development services capacity and capabilities as stated in the “Future Plans and Use of Proceeds” section of the Prospectus, to capitalize on growth opportunities arising in the two largest pharmaceutical markets in the world, the United States and China.

For official press release, please 请点击这里.